Unleashing the Bulls: Why Global Stock Markets Are Roaring Back to Life

Meta Description: Discover the driving forces behind the recent surge in global stock markets, including insights into the performance of the US, European, and Asian markets. Learn about potential risks and opportunities, and understand the factors influencing investor sentiment.

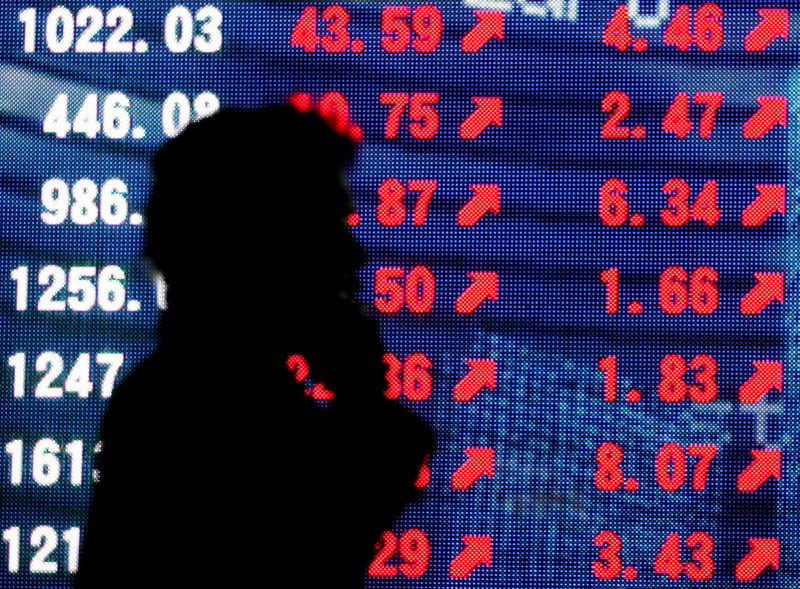

A wave of optimism is washing over global stock markets, sending investors scrambling to catch the rising tide. The recent surge in indices like the S&P 500, Nasdaq, and European stock markets has left many wondering what's fueling this bullish sentiment. It's a complex interplay of factors, from economic data to geopolitical events, and understanding these dynamics is crucial for any investor hoping to ride this wave of growth. This article delves into the heart of this market rally, exploring the key drivers, potential risks, and opportunities that lie ahead. Get ready to dive into the world of global stock markets and understand what's truly driving this upward trajectory.

Economic Recovery: The Engine of Growth

The global economy is slowly but surely bouncing back from the pandemic-induced slump. While inflation remains a concern, central banks are showing signs of easing their aggressive interest rate hikes, offering a glimmer of hope for businesses and consumers alike. This positive economic outlook is a key driver of investor confidence, as companies begin to report stronger earnings and project brighter futures.

Key Economic Indicators Pointing to Recovery:

- Falling Inflation: The US Federal Reserve's recent pause on interest rate hikes, coupled with declining inflation readings, has fueled optimism about a potential soft landing for the economy.

- Strong Consumer Spending: Consumer spending remains robust, indicating a resilient economy. While some argue that this is fueled by accumulated savings from the pandemic, it demonstrates a healthy demand for goods and services.

- Improving Job Market: Unemployment rates remain low, indicating a strong labor market. This translates into higher wages and increased consumer spending, driving economic growth.

Geopolitical Factors: Navigating Global Uncertainty

While the economic recovery is a major factor, geopolitical events continue to shape the market landscape. The ongoing war in Ukraine, tensions with China, and the global energy crisis all contribute to market volatility. However, recent developments, such as the reopening of China's economy and the easing of tensions between the US and China, have injected a dose of optimism into the market.

Understanding the Geopolitical Landscape:

- China Reopening: The reopening of China's economy after strict COVID-19 lockdowns is seen as a major positive for global trade and economic growth.

- Evolving US-China Relations: While tensions remain, there have been recent indications of a more constructive dialogue between the US and China. This could lead to a more stable global order.

- Ukraine War: The conflict continues to be a major source of uncertainty. However, recent diplomatic efforts and the potential for a negotiated settlement offer a glimmer of hope for de-escalation.

The Rise of Artificial Intelligence: A New Frontier for Growth

One of the most significant drivers of the current stock market surge is the unstoppable rise of artificial intelligence (AI). AI is rapidly transforming industries, from healthcare and finance to manufacturing and transportation. This technological revolution is opening up new frontiers for growth and innovation, attracting significant investments and fueling stock market gains.

Understanding the Impact of AI:

- Increased Efficiency and Productivity: AI is automating tasks and processes, leading to increased efficiency and productivity across industries.

- New Products and Services: AI is enabling the development of new products and services, creating new markets and driving economic growth.

- Investment and Innovation: AI is attracting significant investment from companies and governments, fueling innovation and creating new opportunities for growth.

Navigating the Market: Opportunities and Risks

The recent stock market surge presents both opportunities and risks for investors.

Opportunities:

- Growth Potential: The economic recovery, geopolitical developments, and the rise of AI all point to continued growth potential in global stock markets.

- Diversification: Investing in a diversified portfolio of stocks across different sectors and geographies can help mitigate risk.

- Long-Term Growth: The current bull market is likely to continue for some time, offering investors the potential for significant long-term gains.

Risks:

- Inflation: The current inflation is still a concern, and any unexpected upsurge could lead to a correction in the market.

- Interest Rate Hikes: Central banks may still need to raise interest rates further to combat inflation, which could slow economic growth and impact stock prices.

- Geopolitical Uncertainties: The ongoing geopolitical tensions and the potential for unexpected events could lead to market volatility.

FAQs:

Q: What are the main factors driving the current stock market rally?

A: The rally is driven by a combination of factors, including:

- Economic Recovery: The global economy is showing signs of a robust recovery, leading to increased investor confidence.

- Geopolitical Developments: Evolving geopolitical events, such as the reopening of China's economy and potential for de-escalation in the Ukraine conflict, are injecting optimism into the market.

- Technological Advancements: The rise of AI and other transformative technologies is creating new opportunities for growth and innovation, attracting significant investment.

Q: Is this just a temporary bull market, or is it a long-term trend?

A: While it's impossible to predict the future with certainty, the factors driving the current rally suggest that the bullish trend could continue for some time. However, investors should be aware of the potential risks and be prepared for market volatility.

Q: How can investors capitalize on the current market rally?

A: Investors can capitalize on the upward trend by:

- Diversifying their portfolios: Investing in a mix of stocks across different sectors and geographies can help mitigate risk.

- Investing in growth sectors: Sectors like technology, healthcare, and renewable energy are expected to benefit from the ongoing economic recovery and technological advancements.

- Seeking professional advice: Consulting with a financial advisor can help investors develop a personalized investment strategy that aligns with their risk tolerance and financial goals.

Q: What are the biggest risks to the stock market in the coming months?

A: The biggest risks to the stock market include:

- Inflation: Uncontrolled inflation could lead to a rise in interest rates and a slowdown in economic growth, impacting corporate earnings and stock prices.

- Geopolitical Events: Unforeseen geopolitical events, such as escalation of conflicts or trade wars, could create market volatility.

- Interest Rate Hikes: Aggressive interest rate hikes by central banks could lead to a decline in economic activity and dampen investor sentiment.

Q: Is it too late to invest in the stock market?

A: It's never too late to invest in the stock market. While the market has experienced a recent surge, it's important to remember that markets are cyclical and will continue to experience ups and downs. A long-term investment approach that considers both growth potential and risk tolerance is crucial for success.

Q: What is the role of AI in the current market rally?

A: AI is playing a significant role in the current bull market by:

- Driving innovation: AI is enabling the development of new products and services, creating new markets and driving economic growth.

- Boosting productivity: AI is automating tasks and processes, leading to increased efficiency and productivity across industries.

- Attracting investment: The potential of AI is attracting significant investment from companies and governments, fueling innovation and creating new opportunities for growth.

Conclusion:

The current stock market rally is a complex phenomenon driven by a combination of economic, geopolitical, and technological factors. While the outlook is generally positive, investors should be aware of potential risks and adopt a long-term investment strategy. Those who can navigate the market's ups and downs with a clear understanding of the driving forces and potential challenges are likely to reap the rewards of the current bull market. The future of global stock markets is full of potential, and those who are well-equipped with knowledge and a strategic mindset are poised to ride the wave of growth.